Hainan Rubber to Acquire 36% in Halcyon Agri, Announces Pre-Conditional Mandatory Cash Offer

- Hainan Rubber has entered into SPA with Sinochem to acquire 36% of Halcyon Agri,

triggering a MGO. - The Offer Price is US$0.315 (SGD equivalent S$0.441) per Share in cash, and is subject

to fulfilment of certain conditions. - Sinochem shall remain second largest shareholder in Halcyon Agri, holding 29.2% stake, after the Share Acquisition, and undertake to reject the mandatory cash offer.

- Halcyon Agri will remain listed on SGX-ST, as intended by the Offeror.

SINGAPORE, 17 November 2022 – China Hainan Rubber Industry Co., Ltd (“Hainan Rubber” or “Offeror”) announced today that it has entered into a conditional share purchase agreement (“SPA”) with Sinochem International (Overseas) Pte Ltd (“Sinochem”) for the purchase of an aggregate of 574,204,299 ordinary shares (the “Sale Shares”, and each a “Sale Share”), representing 36% of the issued and paid-up capital of Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company”, and together with its subsidiaries, the “Group”) as at the date of the SPA for an aggregate cash consideration of approximately US$180.9 million, being US$0.315 for each Sale Share (equivalent to approximately S$0.441 for each Sale Share) (“Share Acquisition”).

Hainan Rubber further announced a pre-conditional mandatory cash offer (the “Offer”) to acquire all the issued and paid-up ordinary shares (“Shares”) in Halcyon Agri it does not already own at US$0.315 per share in cash (the “MGO”).

Pre-Conditions of the MGO

The Share Acquisition will result in the Offeror holding more than 30% of the issued and paid-up share capital of the Company, hence triggering an obligation, under the Singapore Code on Take-overs and Mergers (“Code”)2, to make the MGO.

The making of the MGO is conditional upon the completion of the Share Acquisition, which shall only take place upon the following conditions being fulfilled:

Effective Conditions for SPA to become effective

(a) Approval by the board of directors of Hainan Rubber and Sinochem and the SPA having been duly executed by both parties;

(b) Approval by Hainan Rubber’s shareholders vide an extraordinary general meeting; and

(c) Approval by State-owned Assets Supervision and Administration Commission of the State Council of the People’s Republic of China (“PRC”);

Conditions Precedent for the closing of the Share Acquisition (“Closing”)

(a) Approval by the competent state-owned assets supervision and administration body for each of Hainan Rubber and Sinochem;

(b) Approval by relevant government authorities in accordance with the applicable laws of PRC in order to consummate the Share Acquisition;

(c) Passed anti-trust reviews by the relevant competent authorities in the relevant jurisdictions; and

(d) Sinochem and Hainan Rubber not having received notice from any governmental authorities or any stock

Upon the fulfilment of the pre-conditions within a six-month timeline from the effective date of the SPA, an announcement will be made on the firm intention on the part of Hainan Rubber to make the MGO.

Intention of Offeror

The Offeror announced its intention for Halcyon Agri to remain listed on the SGX-ST following the completion of the MGO, and they have no intention to introduce any major changes to the existing business or management of the Group.

There are no changes to the Group’s vision and business strategy to be the leading natural rubber global franchise, and focus on creating value to its customers, employees and stakeholders.

Terms of MGO

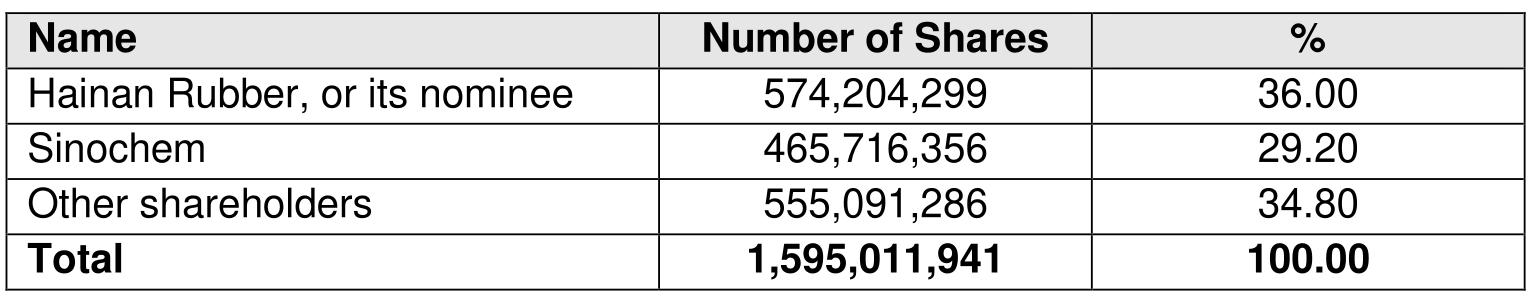

The below outlines the shareholding structure of the Company after Share Acquisition, before the MGO:

The MGO will not become unconditional unless the Offeror and parties acting in concert with it hold more than 50% of voting rights attributable to the issued shares of the Company as at the close of the MGO.

Sinochem has provided an irrevocable undertaking to the Offeror that they will continue to maintain a 29.20% shareholding in the Company from the date of Closing until and including the date on which the MGO closes, lapses or is withdrawn, and will reject the Offer in respect of their shareholding after Closing.

Appointment of Independent Financial Adviser (“IFA”)

Subject to the Offer being made, the Directors will in due course appoint an IFA to advise the independent directors on the Offer.

###

This press release should be read in conjunction with the full text of the Offer Announcement dated 17 November 2022. In the event of any inconsistency or conflict between the press release and Offer Announcement, the terms set out in the Offer Announcement shall prevail. Capitalised terms used but not otherwise defined herein shall have the meanings given to them in the Offer Announcement. The Offer Announcement is available on www.sgx.com.

Shareholders and potential investors should exercise caution when trading in HAC Shares, and where in doubt as to the action they should take, they should consult their financial, tax or other advisors.

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.