Halcyon Agri Provides Q1 2023 Business Update

SINGAPORE, 22 May 2023 – Halcyon Agri Corporation Limited (“Halcyon Agri”, the “Company” and together with its subsidiaries, the “Group”) today provides voluntary business update for the first quarter ended 31 March 2023 (“Q1 2023”).

The Group maintains its momentum in Q1 2023 to grow its market share compared to Q1 2022 amid challenging market conditions. Global slowdown of demand and worldwide destocking has caused SICOM to remain sluggish. With raw material prices remaining persistently high, the effect of margin compression is more apparent as we are in a low rubber tapping season that generally ends mid to end April. The Group continues to focus on creating added value to the customers, as well as managing the overall cost amidst the uncertainty in the market.

In addressing the high-interest rate environment, the Group continues to make good progress on its deleverage plan – the disposal of non-core assets generated US$5.2 million gain during Q1 2023.

Latest Development Update – Mandatory General Offer (“MGO”) by China Hainan Rubber Industry Group Co., Ltd. (“Hainan Rubber”)

The MGO has officially closed on 24 April 2023, with Hainan Rubber garnering 68.103% of the total number of shares. As the public free float fell below the requisite 10%, the trading of Halcyon Agri’s shares has been suspended with effect from 25 April 2023. The Group is undertaking necessary actions, in collaboration with Hainan Rubber, to restore free float and resume the trading of its shares on SGX within the stipulated period. The Group will make further announcements as and when there is any material development.

CEO Remarks

Commenting on the Group’s Q1 2023 progress, Mr Li Xuetao (李雪涛), Chief Executive Officer said, “Notwithstanding the transitioning global economic landscape, we continue to make progress towards our operational and financial goals. The Group’s immediate priority is to achieve smooth integration with Hainan Rubber, to which we have had in-depth discussions to explore collaboration opportunities and seek ways to achieve mutual growth, while keeping our costs structure in check amidst an inflationary environment.”

Mr Li added, “We continue to strive our best in navigating the headwinds and challenges in the near term, but we believe that the long-term demand remains intact. We are closely monitoring the effects of China’s reopening and the potential pause of interest rates hike by the Federal Reserve. Overall, we remain cautiously optimistic towards the Group’s prospects.”

Financial Performance Summary

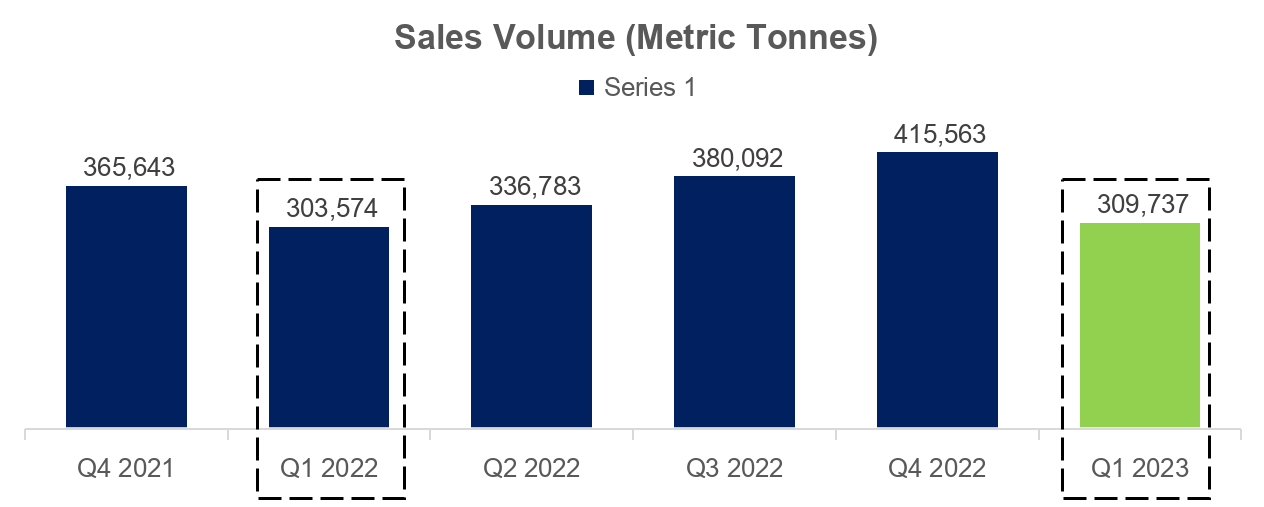

Q1 2023 sales volume grew to 309,737 mT from 303,574 mT in Q1 2022, attributed to the Group’s capture of market demand through its vertically integrated capabilities.

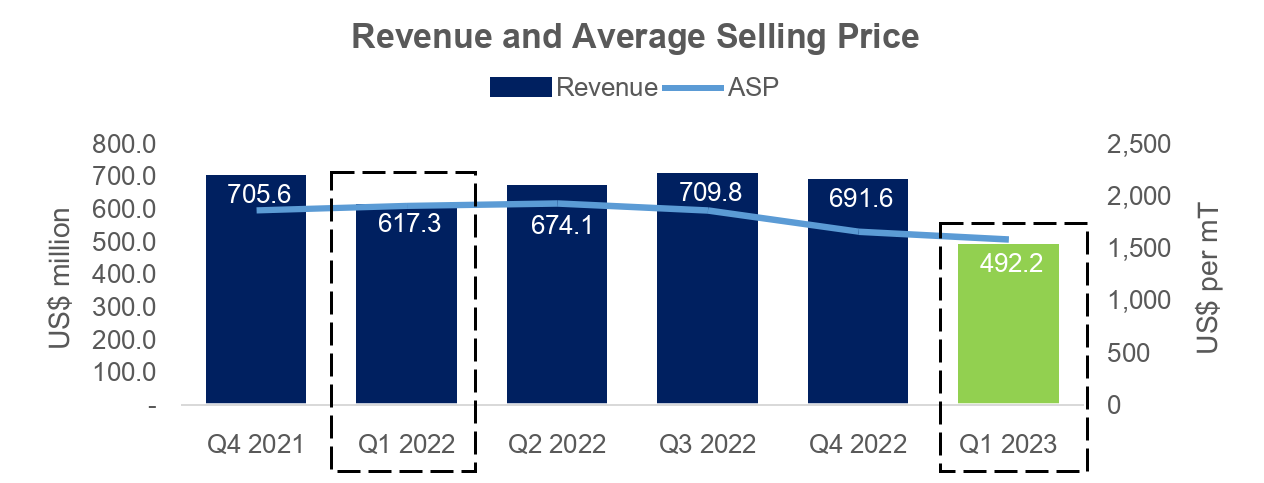

Q1 2023 revenue decreased to US$492.2 million from US$617.3 million in Q1 2022, in tandem with the market price movement in recent periods.

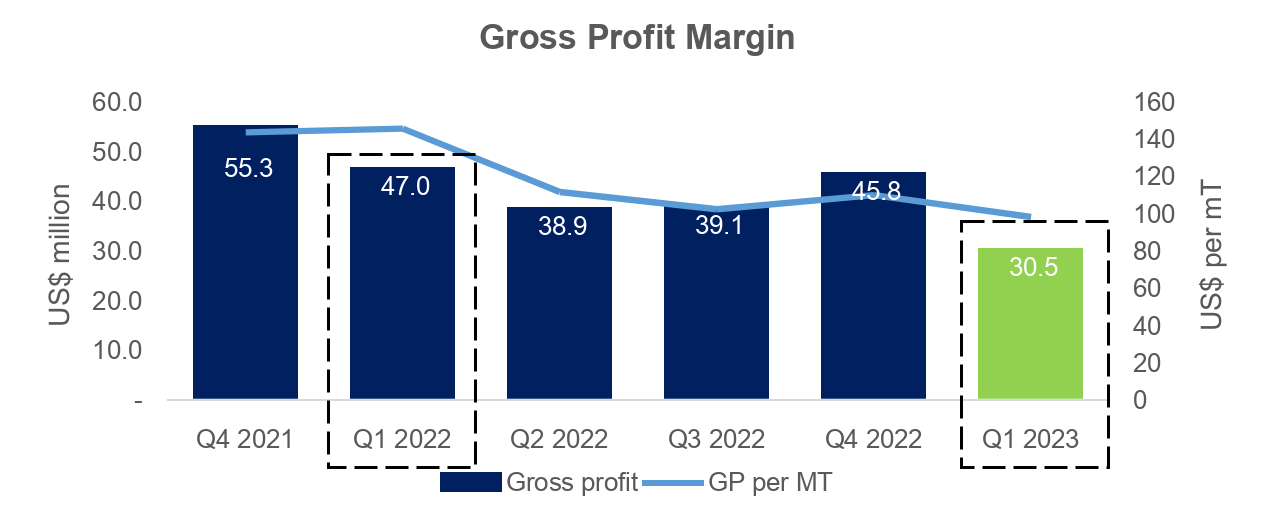

The Group reported gross profit of US$30.5 million in Q1 2023, compared with US$47.0 million in Q1 2022, as we battled the effects of margin compression.

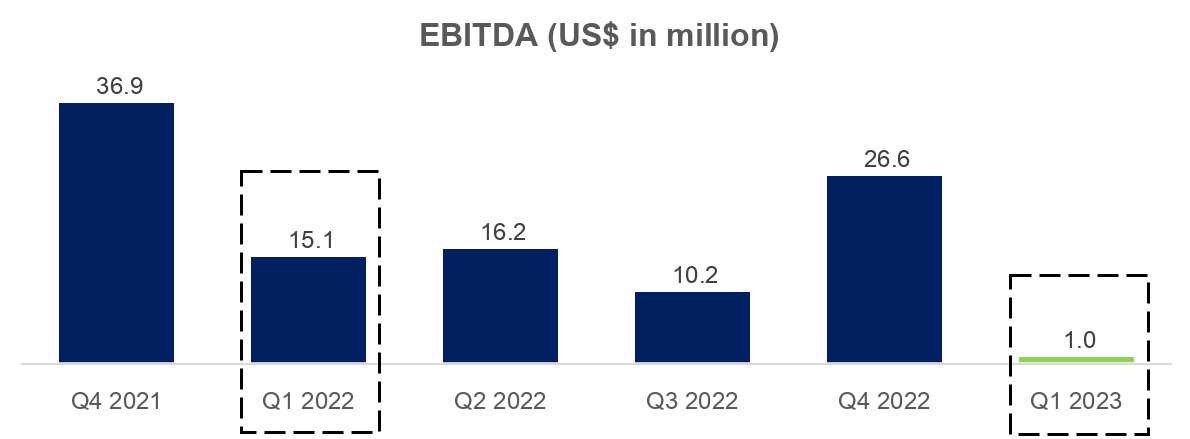

The Group’s EBITDA of US$1.0 million in Q1 2023 moved in tandem with our gross profit.

###

About Halcyon Agri

Halcyon Agri is a leading supply chain franchise of natural rubber with global presence. Headquartered in Singapore and listed on the Singapore Exchange (SGX: 5VJ), the Group owns and operates significant assets along the natural rubber value chain, and distributes a range of natural rubber grades, latex and specialised rubber for the tyre and non-tyre industries. It has 38 processing factories in most major rubber producing origins with production capacity of 1.6 million mT per annum, and is one of the largest owners of commercially operated rubber plantation globally.

Halcyon Agri comprises two major business units:

- Halcyon Rubber Company (HRC) is the pre-eminent supplier of natural rubber to the global tyre fraternity. HRC Group owns and operates 36 factories with wide-ranging approvals from the tyre majors. The factories, compliant to stringent manufacturing standards, are located across the key rubber origins, including Indonesia, Malaysia, China, Thailand and Ivory Coast.

- Corrie MacColl (CMC) is a leading provider of specialist polymers for industrial and non-tyre applications. It comprises of two units: CMC Plantations (CMCP), which owns one of the largest commercially owned and operated plantations globally and CMC International (CMCI), a commercial and distribution platform with global third-party procurement capability, which supports the customers’ requirements by providing full suite of logistic and technical services.

With a multinational workforce of more than 15,000 employees in over 100 locations globally, Halcyon Agri embraces sustainability as its core business tenet, and has stringent standards in place to ensure its products are sustainably sourced and responsibly produced.

Please visit us at www.halcyonagri.com

Follow us on social media

Linkedin: Halcyon Agri

Twitter: @HalcyonAgri

Wechat: 合盛 Halcyon Agri

Contacts

Investor relations

Tel: +65 6460 0200

Email: