Thailand Natural Rubber Economics

A study about smallholders and dealers on production cost, land cost and return on investment in South Thailand.

By Dilok Lee

Deputy CEO, Factory Operations, Teck Bee Hang Co., Ltd. Thailand

1. Introduction:

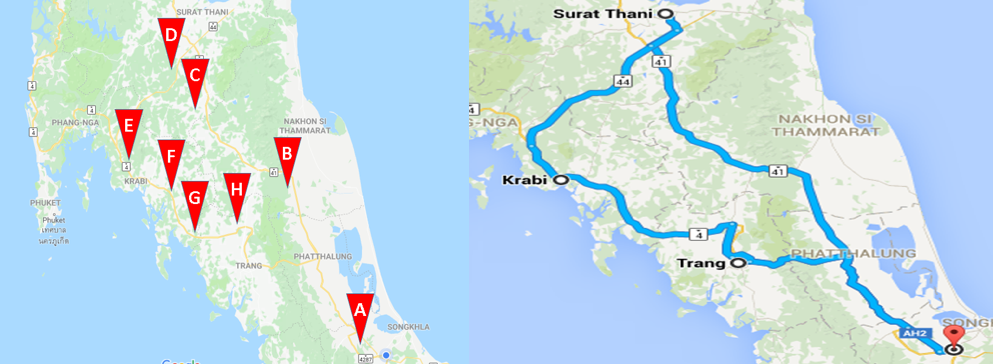

This study is conducted from our routine visit to smallholders and dealers in South Thailand in August 2018. The area covered can be seen in the map below:

Rubber smallholders in the South are generally divided into two groups: Medium to large owners of holdings over 50 rai or 8 Ha; they usually hire workers for tapping and processing into unsmoked sheet. 40% to 50% of their revenue is shared with the workers. Large farmers may also plant other crops such as oil palms and have other businesses; their livelihood is less affected by NR prices.

The other group are the smallholder farmers of not more than 10 rai or 1.6 Ha. They usually tap rubber trees by relying on family members or neighbours and do not depend on outside workers. In this case, family members keep 100% of the revenue.

It is often pointed out that farmers in the South have been more severely affected by low NR prices than those in the North and North East regions as they are monoculture farmers and must buy basic staples from the market. On the other hand, farmers in the North East also plant staple foods such as rice and other cash crops, including tapioca, fruit and vegetables. Farmers in the North East also plant and tap trees using family members.

Table 1: Status of a typical smallholder in the South:

| Farmer profile |

|

| Impact of NR price |

|

| Selling avenue |

|

| Evaluation of Government policy |

|

90 % of NR productions in Thailand is produced by smallholders while 10% comes from estates/large scale holders. Most rubber is sold from farmers through collectors. It accounts for about 65% of smallholders’ output. From farmers to processors, they may pass through two or more middlemen, and about 4% of the cost is passing on to the next middleman. They may be sold as field latex, unsmoked sheet, cup lump or crepe blankets. Selling to associations or cooperatives account for around 20% of the transactions. Farmer associations or cooperative purchase smoked sheet or unsmoked sheet from its members, then sell to processors. Farmers also sell both smoked and unsmoked to central markets accounting for 5% of total smallholders’ productions.

Table 2: Terms of payment and delivery from farmer to processor

| Buyer level | Collectors | Association/Cooperative | Central Market |

| Accessibility | Easy access by farmers | By membership only | Located in major town, inconvenient for most farmers |

| Terms of payment | Same day cash payment on delivery | A few days after delivery | A few days after delivery |

| Product | USS/RSS/Cup lump/latex/Crepe blanket | USS and RSS | USS and RSS |

| Margin to purchaser | 4 to 9 % | Lower than collectors | nil |

2. Cost Breakdown:

1. Initial planting and maintenance cost:

| Year | Description | Cost (Baht/rai) |

| 1 | Land clearing, preparation and planting | 5,402 |

| 2 | Maintenance and fertiliser | 2,234 |

| 3 | Maintenance and fertiliser | 2,614 |

| 4 | Maintenance and fertiliser | 3,154 |

| 5 | Maintenance and fertiliser | 1,434 |

| 6 | Maintenance and fertiliser | 1,434 |

| 7 | Maintenance and fertiliser | 1,434 |

| Miscellaneous expense before tapping | 2,596 | |

| Total | 20,302 |

This initial cost is amortised over a period of 30 years at 676 Baht/rai/year.

2. Recurring maintenance and fertilising cost:

| Year | Description | Cost (Baht/rai) |

| 8th year onwards | Weeding and labour Fertiliser | 148 500 |

| Total | 648 |

3. Thailand NR yield:

| Region | Kg/rai | Kg/Ha |

| Northern | 161 | 1,006 |

| Northeastern | 209 | 1,306 |

| Central | 195 | 1,219 |

| Southern | 254 | 1,588 |

| Overall | 235 | 1,469 |

Source: Agricultural Information Center, Office of Agricultural Economics. (2016). Crop Production Survey – Para Rubber report 2016. (in Thai)

3. Cost of Production for Smallholders (Owner Tapper) and FOB Cost

Assumptions:

a. Plantation size: 10 rai

b.Rubber yield: 235 Kg/rai/year

c. Initial investment cost: 676 Baht/rai/year

d. Maintenance and fertiliser cost: 648 Baht/rai/year

e. Minimum wage: 310 Baht/day

f. Tapping days: 300 days per year

g. Tapping and labour cost: (310 Baht/day X 300 days)/235 Kgs = 39.57 Baht/Kg

h. Collectors’ handling cost and profit (4% from each middleman)

Table 3: Summary of FOB cost

| Item | Description | Cost Baht/Rai/year | Cost Baht/Kg |

| 1 | Planting and maintenance for the first 7 years | 676 | 2.87 |

| 2 | Fertiliser and maintenance from year 8 | 648 | 2.75 |

| 3 | Labour | 9,300 | 39.57 |

| 4 | Farm gate cost | 45.19 | |

| 5 | Middlemen handling costs and profit (8% assuming passing through 2 middlemen) | 3.61 | |

| 6 | Delivery to factory cost | 48.80 | |

| 7 | Processing and other FOB costs (include replanting cess at 2 Baht/Kg) | 7.80 | |

| 8 | FOB cost | 56.60 | |

| 9 | FOB cost in US dollar; exchange rate 33 Baht to $ 1 | 1.71 |

In most cases, farmers may ignore their initial investment costs. Under this scenario, the minimum expected farm gate price is 39.57 Baht/Kg.

4. For Large or Medium Size Holdings (more than 50 rai Owner Sharecrop with Tapper)

Assumptions:

a. Plantation size : 50 rai (8 Ha)

b.Rubber yield: 235 Kg/rai/year

c. Each tapper can tap 10 rai per day; the owner has to maintain 5 workers

d. Sharing revenue, owner/tapper: 50:50 or 40:60

e. Tapper works 300 days per year

f. Maintenance and fertilizer: 1,321 Baht/rai/year (x 50 rai = 66,050Baht)

| Scenario 1: Owner/Tapper share at 50:50 | ||||||

| Rubber price (Baht/Kg) | Total Revenue (Baht) | Owner’s Revenue (50% of rev.) | Owner’s Cost (Baht) | Owner’s Net Income (Baht) | Tapper’s Share (50% of rev.) | Daily income for each tapper (Baht) |

| 70 | 822,500 | 411,250 | 66,050 | 345,200 | 345,200 | 230 |

| 60 | 705,000 | 352,500 | 66,050 | 284,450 | 284,450 | 189 |

| 50 | 587,500 | 293,750 | 66,050 | 227,700 | 227,700 | 152 |

| 40 | 470,000 | 235,000 | 66,050 | 168,950 | 168,950 | 113 |

| Scenario 2: Owner/Tapper share at 40:60 | ||||||

| Rubber price (Baht/Kg) | Total Revenue (Baht) | Owner’s Revenue (40% of rev.) | Owner’s Cost (Baht) | Owner’s Net Income (Baht) | Tapper’s Share (60% of rev.) | Daily income for each tapper (Baht) |

| 70 | 822,500 | 329,000 | 66,050 | 262,950 | 493,500 | 329 |

| 60 | 705,000 | 282,000 | 66,050 | 215,950 | 423,000 | 282 |

| 50 | 587,500 | 235,000 | 66,050 | 168,950 | 352,500 | 235 |

| 40 | 470,000 | 188,000 | 66,050 | 121,950 | 282,000 | 188 |

From the above tables, it can be inferred that plantations relying on employing workers to tap will need rubber price to be between 60 to 70 Baht/Kg. At this level, the owner can afford to employ workers by paying the minimum daily wages. Also, the owner has to allocate 60% of the revenue to the workers.

5. Land Cost and Return on Investment

Average agricultural land in the South is valued at about 200,000 Baht/rai. We have done some calculations on the return on investment for planting rubber which is summarised in the following two tables.

1. Large or medium size holdings (more than 50 rai)

| Rubber price (Baht/Kg) | Plantation Size 50 rai (8 Ha) | Land Cost (200,000Baht/rai) (Baht) | Owner’s IRR (internal rate of return) (%) | |||

| Total revenue (Baht) | Owner’s revenue (40%) | Owner’s cost (Baht) | Owner’s income (Baht) | |||

| 70 | 822,500 | 329,000 | 66,050 | 262,950 | 10,000,000 | -1.23% |

| 60 | 705,000 | 282,000 | 66,050 | 215,950 | 10,000,000 | -2.34% |

| 50 | 587,500 | 235,000 | 66,050 | 168,950 | 10,000,000 | -3.64% |

| 40 | 470,000 | 188,000 | 66,050 | 121,950 | 10,000,000 | -5.23% |

2. Smallholder

| Rubber price (Baht/Kg) | Plantation Size 10 rai (1.6 Ha) | Land Cost (200,000Baht/rai) (Baht) | Owner’s IRR after deduct min. wage | Owner’s IRR, excl. min. wage cost | ||||

| Total revenue | Maint. Cost | Minimum wage | Net Income, after deduct min. wage | Net Income, excl. min. wage cost | ||||

| 70 | 164,500 | 19,838 | 93,000 | 51,662 | 144,662 | 2,000,000 | -1.33% | 6.07% |

| 60 | 141,000 | 19,838 | 93,000 | 28,162 | 121,162 | 2,000,000 | -4.54% | 4.52% |

| 50 | 117,500 | 19,838 | 93,000 | 4,662 | 97,662 | 2,000,000 | -11.99% | 2.82% |

| 40 | 94,000 | 19,838 | 93,000 | (18,838) | 74,162 | 2,000,000 | n/a | 0.89% |

At first glance, the above calculation shows that rubber planting is not an attractive investment in the South, especially for new investors. It goes to show that Thailand NR productions will stop growing in the future.

Smallholders, in general, are traditional farmers who are landowners since their forefathers’ days. They will continue to be the main source of supply. Large or medium size owners may have to consider other alternatives if there are potential to develop their land for a better return.

6. Raw material price as on 12th of September, 2018:

Field latex: 40.50 Baht/Kg

Unsmoked sheet: 42.50 Baht/Kg

Cup Lump: 37.50 Baht/Kg

7. Conclusion:

From the above, we can draw the following conclusions:

1. Minimum acceptable NR price for large rubber plantations owner: 60 to 70 Baht/Kg; at this level, he can afford to employ workers to tap. He will also be able to receive some income to cover his planting and maintenance costs.

2. Minimum acceptable NR price for smallholder: 45 Baht/Kg; At this price level, his income is similar to what he would receive if he is working elsewhere as an employee.

3. Higher yield will help to lower unit labour cost and boost income.

4. Despite low NR price, smallholder output will continue to be the main supply source of natural rubber. Supply from medium to large holdings are limited if the price remains low.

5. Low rubber prices are a disincentive for farmers to apply fertiliser to their trees. In the years to come, NR yield will drop.

6. Low rubber price has discouraged new planting. It can be expected that NR production in Thailand will stop growing in the near future.

7. Low rubber price will see the conversion of large and medium-size rubber plantations for other alternative investments.

8. Despite low return on investment, rubber planting will continue to be the main source of income for smallholders in South Thailand.